The Truth Behind Venezuela’s Adoption of Bitcoin

Stories have been circulating about bitcoin usage in Venezuela, which has been and still is experiencing a historic economic crisis. Against the backdrop of hyperinflation and extreme poverty, pieces in media outlets like the BBC and the New York Times reinforce what many crypto-enthusiasts have been spreading online and in events:

Many Venezuelan’s are turning to bitcoin to preserve their savings in the face of the Bolivar’s downward spiral.

Venezuela became one of the biggest crypto markets in the world.

The above claims support an appealing narrative: bitcoin democratizes mass access to financial security that is free from central bank mismanagement and government oppression.

There are problems with these claims.

The evidence is cherry-picked and misinterpreted

Data from Coin Dance is unanimously cited as evidence of Venezuela’s “exploding” bitcoin trade. Coin Dance’s Venezuela data comes from one source, LocalBitcoins.com, which is an OTC hub that facilitates the buying and selling of bitcoins (BTC) between people.

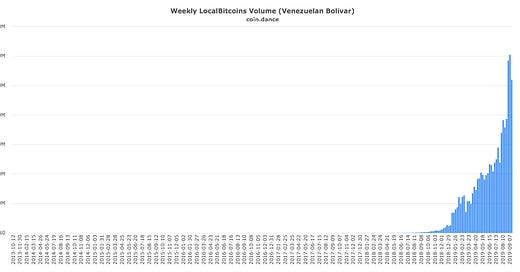

The chart below (from Coin Dance) is used to demonstrate the dramatic increase in BTC trading in Venezuela. It shows steep growth in trading volumes over the past two years. The problem with this chart is that the figures are in Venezuela’s currency, the Bolivar, which has been plummeting in value at a ridiculous rate, and is often called “worthless.” As a result, bitcoin’s price (in Bolivars) shot up by +41872% in one year! This is a hyperinflation chart if anything. It makes no sense to track the bitcoin trade in Bolivars.

The same data tells a counterstory when plotted differently. In both US Dollar and BTC terms, trading volumes have been declining since they peaked in February 2019.

Over several days, I monitored LocalBitcoins.com and found anywhere between 500 and 700 bitcoin buy/sell ads posted in Venezuela. Most of the traders have a thousand or more confirmed trades, with some reaching 40,000. Given Venezuela’s 32 Million population, it appears that the BTC trade there is limited to a small yet very active community.

Is Venezuela one of the biggest markets for crypto in the world? On LocalBitcoins.com, maybe. There are countless other OTC sites and exchanges with opaque and fragmented reporting, so it’s impossible to have accurate comparative data. Consider this: an excess of 250,000 bitcoins were traded globally in the week of September 14th vs. 489 in Venezuela. It’s hard to justify the “one of the biggest markets” claim.

Venezuelan’s are too poor to consider Bitcoin, and they prefer the US Dollar

A Venezuelan friend gave me more insights:

There are two parallel economies in the country. First, there are people in the minority who maintain and operate their capital in US dollars. Typically, they are people with savings, business owners with income in dollars (or enough income in local currency to exchange to USD), and recipients of international remittances.

Then, there are the people who are living day-to-day, earning wages in the local currency, or are unemployed. These represent 87% of Venezuelans who live in poverty (Source in Spanish). What’s more, almost a third of Venezuelan’s are unbanked. A poor Venezuelan with little to no savings and no bank account will not and cannot transact in bitcoins.

The US Dollar is much more accessible and accepted than bitcoins. About 30% of all transactions in Venezuela are made in US dollars. This percentage will grow since the government is unable to restrict the greenback’s adoption (Source).

A few years ago, mining bitcoins in Venezuela became popular, given the cheap electricity. This, however, was only available to people with enough capital to make the initial investment. Venezuelan Bitcoin miners probably form the core group of traders on LocalBitcoins.com. They belong to the minority of Venezuelan’s who are relatively well-off.

=======

The Venezuela bitcoin story is not what the crypto-community would like it to be. Bitcoin seems to be serving a small group of Venezuelans very well. However, it’s absurd to frame it as a panacea for financial inclusion and security in isolation of proper monetary policies, poverty eradication, and financial literacy measures.

This article was first published on LinkedIn on September 27, 2019.