The Pandemic-Induced Digital Transformation in Charts

Data on Telehealth usage, SaaS revenue growth, and tech jobs cast doubt on the accelerating digital transformation narrative

Welcome to the latest edition of my newsletter. If you are not a subscriber, please use the button below to sign up. You can send your feedback to mohammed@ovahi.com or @ghalayini_m. And if you enjoy today’s essay, please share it with others!

Data from Q2 and Q3 of this year show that the pandemic-induced acceleration of digital transformation isn’t taking shape as believed by many. Below I present charts that demonstrate retreating Telehealth trends, uneven SaaS revenue growth rates, and declining demand for tech jobs. Put together, this data confirms that despite the realities of remote work, social distancing, and lockdowns, rapid digitization is limited to a few domains (like e-commerce and communication). Digitization is otherwise curtailed by the sheer weight of the economic downturn and is showing signs of being fleeting.

In the US, Telehealth visits tapered off after peaking in April

The chart below is from Epic Health Research:

Many speculated that telehealth volumes would remain high throughout (and perhaps beyond) the pandemic; however, recent EHR data show that volumes peaked in mid-April when telehealth visits comprised 69% of total visits. Since then, levels have dropped to make up only 21% of total visits, though this is still much higher than the rates seen before the pandemic (less than 0.01%).

So what?

Twenty-one percent is a significant increase from pre-pandemic levels, however, the US is still in the midst of the pandemic, and a variety of lockdown measures are in effect. It’s likely that Telehealth visits will further fall when the pandemic subsides.

Habits are hard to change. What are perceived today as permanent shifts in behaviours may be, in fact, temporary.

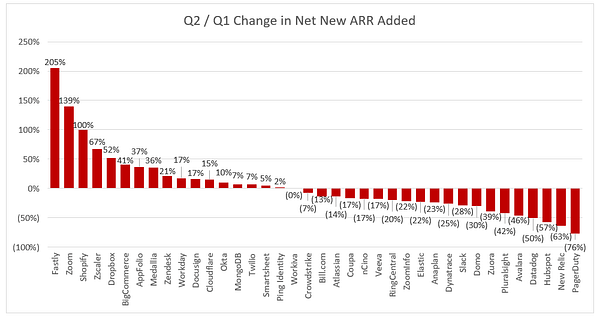

Revenues didn’t accelerate for most SaaS companies

Software-as-a-Service companies are important enablers of digitization: their cloud-based and innovative solutions power automation, communication, and e-commerce. Jamin Ball of Redpoint VC tweeted two charts that show the unevenness of SaaS revenue growths between Q2 and Q1 of 2020.

So what?

Unsurprisingly, e-commerce and communications companies are disproportionately benefitting during the crisis. People are shopping online and are working remotely. Other categories of SaaS companies have seen normal ranges of growth similar to previous years, or even slowdowns.

Companies are reexaminings their tech budgets and digital plans as a result of the economic crisis.

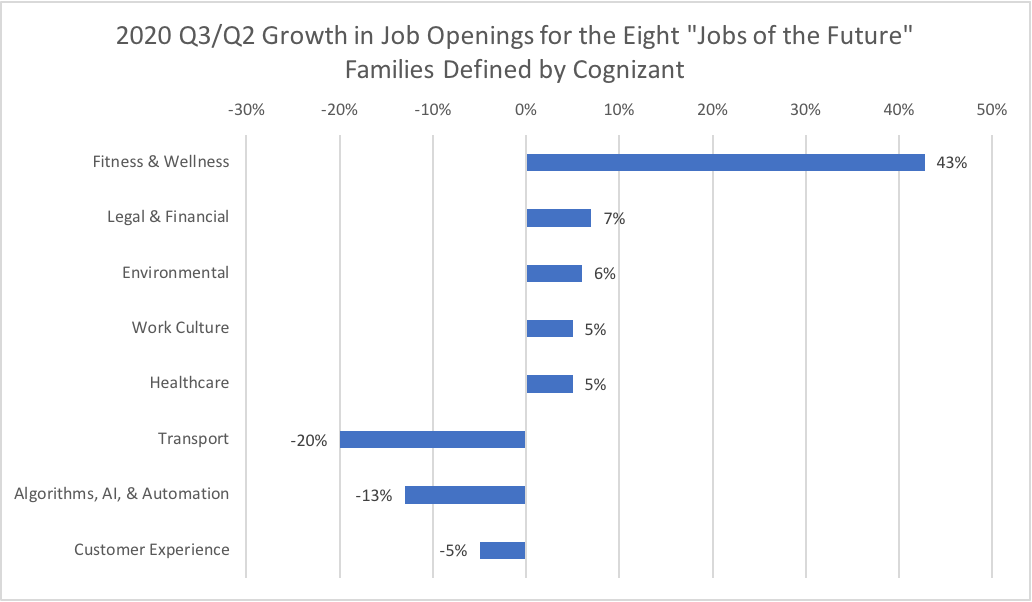

Demand for tech jobs is declining

In the two charts below, both Cognizant and Indeed show a reduction in demand for tech jobs.

So what?

Joe Weisenthal, an editor at Bloomberg, provided this clever assessment: “You can think of a software hire as being akin to a capital investment. As such, this should raise some concerns about economic productivity going forward, if companies are spending less on long-term investment and projects now.”

And, Robert Brown from Cognizant had this punchy observation: "American companies are focused on keeping the lights on rather than investing in digital growth.”

The battle of the surveys continues

Still, some surveys, like this one run by McKinsey, are showing with high confidence that “COVID-19 have speeded digital adoption by several years.” On the other hand, Cognizant, found that 35% of respondents to one of its own surveys said that they slashed their digital budgets. Why the contradictions? I’m afraid it’s impossible to know since we don’t have the details behind who was surveyed and what questions were asked. Human biases are also at play for both survey responders and interprerters, these are difficult things to correct for in tumultuous time.

I can predict, with high likelihood, that we will be seeing contradictory digitization studies and opinions in the near future.

=====

Notes and Sources:

Photo by engin akyurt on Unsplash.

“Telehealth: Fad or the Future,” Epic Health Research Network.

“Jobs of the Future Index: Q3 2020”, Cognizant.

Indeed job opening analysis, reported by Bloomberg.