On Bitcoin's Energy Use

Bitcoin’s self-appointed talking heads have gone on yet another aggressive campaign to defend the cryptocurrency. This time the casus belli is the bitcoin network’s excessive electricity consumption, estimated at 116 TWh/year, a bit more than the annual electricity consumption of the Netherlands.

The campaign went into overdrive after Tesla announced its quick reversal from accepting bitcoin as payment for its cars, citing environmental concerns. Bitcoin’s price fell dramatically, by about 50% from its peak.

Let’s look at some of the claims, inaccuracies, and rhetoric used to justify bitcoin’s electricity problem.

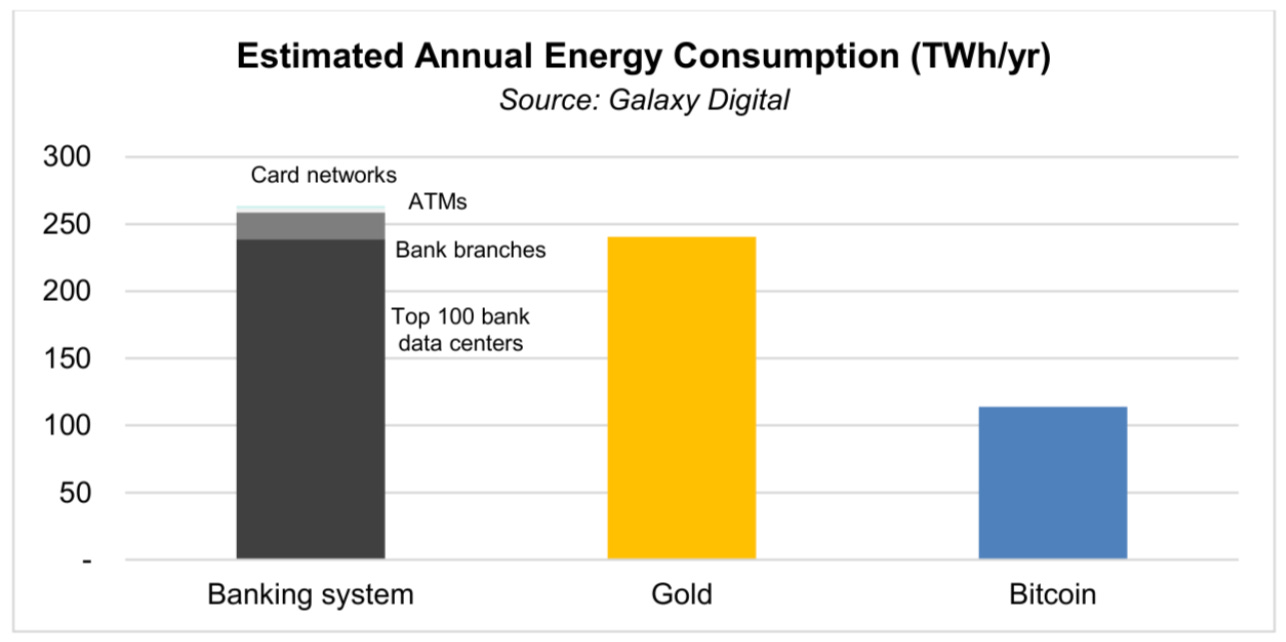

Claim: Bitcoin uses significantly less energy than both the banking system and gold. It is the most climate-friendly financial system.

The chart below shows that the bitcoin network consumes less than half the energy consumption of both the global banking system and the gold industry.

Of course, bitcoin uses less energy out of the three. But these comparisons are ludicrous:

First of all, bitcoin serves a fraction of the global population compared to banking and gold. According to some recent estimates, there are about 100 million bitcoin holders globally. The banking system serves ~3.8 billion worldwide. And as for gold, I’m not sure if anyone can estimate the number of individuals owning jewelry containing gold.

Secondly, bitcoin is limited to very narrow use-cases: a “store of value” or speculative asset. The banking system has countless commercial, payment, and consumer applications. And gold is used not only for jewelry (50%) but also for investments (20%), as central bank reserves (17%), and for industrial purposes (12%).

So, globally, bitcoin serves a small fraction of the population and doesn’t come close to the usefulness of the banking system or gold.

If bitcoin is to become a global mainstream financial system, i.e. with billions of people tapping into it, its ecosystem will have to become ever more complex with more exchanges, more “on-ramps,” more integrations, and more “layer 2” solutions. At that point, it would most definitely catch up to or even surpass the electricity consumption of the banking and gold industries.

Claim: Bitcoin is Key to an Abundant, Clean Energy Future.

This claim is a tad egotistic and diminishes decades’ worth of energy innovations. Smart grids, utility-scale energy storage technologies, electric vehicles, smart-home tech, alternative energy sources & fuels, and policy choices will all work together to create a more sustainable and abundant clean energy future. Bitcoin is not a key to this.

Bitcoiners’ assertion stems from the fact that there’s always some wasted renewable energy. This is true to a certain extent and is being continually addressed by the electricity generation and distribution industries. The waste, or curtailment in industry parlance, is caused by seasonal mismatches between renewable electricity supply and consumer demand. For example, California generates excess electricity from solar on sunny and mild spring days; that’s when air-conditioning use is low. Wind power is also seasonal; wind plant performance tends to be highest during the spring and lowest during mid-to-late summer.

The proposed solution by the bitcoin community is to turn the waste into money. This would happen by directing excess renewable power to power-hungry bitcoin miners who would switch on dedicated machines on-demand. Miners would pay for the electricity from their bitcoin proceeds. Everybody wins. And there's now an incentive to build more renewables since the economics are more lucrative.

I’m sorry to say that there are many reasons why this may not work (check out the Notes section at the bottom of the article). A couple of reasons I thought of:

Utility-scale renewable power plants are designed to operate for 25 years. And as capital-intensive projects with low margins, their financial modelling would require high certainty about the future. This is at odds with how bitcoin miners operate; they are opportunistic and location-agnostic, chasing the cheapest source of electricity.

Bitcoin price volatility could spell chaos within the bitcoin mining industry with potential bankruptcies, mergers, poolings, and geographic concentration/dispersal. It would be impossible to forecast bitcoin mining demand for electricity within a market. Big capital expenditures require reasonable forecasts.

The China Paradox

Chinese mining pools control about 65% of the Bitcoin network’s collective hashrate, which means that most of bitcoin’s electricity consumption occurs in China.

The bitcoin media, Twitterati, and spokespeople have been downplaying China’s overreliance on coal power while advocating that Chinese bitcoin miners are powered “mostly” by clean hydropower. Highlighting that the excess electricity generated during the wet season would’ve been wasted had bitcoin miners not consumed it.

This storyline was disproved when China recently issued a ban on bitcoin mining in the country due, in part, to the egregious electricity consumption and the ensuing carbon footprint. The South China Morning Post:

Miners who have taken advantage of cheap, coal-powered electricity in places like Xinjiang, Sichuan, and Inner Mongolia, are finding that [the State’s] tolerance [for bitcoin mining activity] is fading fast.

So, in the end, there is no basis for the claim that most of bitcoin’s electricity consumption is clean or carbon-neutral.

Western bitcoin voices quickly adapted and welcomed China’s bitcoin mining ban saying that it would reduce the country’s leverage, improve security, and yes, lead to a greener future.

But isn’t it intellectually dishonest to welcome any government regulations that limit bitcoin operations? Isn’t bitcoin supposed to be decentralized and democratized? Maybe this only applies to the West.

A sign of hope, maybe?

Elon Musk’s tweet about Tesla’s abandonment of bitcoin as a form of payment due to environmental concerns was a powerful form of activism. This activism isn’t available to the average bitcoin user; there is no way for an investor to distinguish a clean bitcoin from a dirty one.

Musk’s activism catalyzed the formation of the Bitcoin Mining Council, which will "promote energy usage transparency" and encourage miners to use renewable sources. It remains to be seen if such a council can have any positive impact. The nature of bitcoin’s decentralization will be an obstacle since anyone with resources can be a miner using any form of energy in any place in the world.

A better way would be to re-architect bitcoin to become less energy-intensive, but this will require changes to the bitcoin protocol. A bit farfetched at the moment.

=====

Notes & Sources:

Photo by Rahul Pabolu on Unsplash.

Cambridge Bitcoin Electricity Consumption Index, The University of Cambridge.

“On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question,” Galaxy Digital.

Gold Holdings, Wikipedia.

Measuring Global Crypto Users, Crypto.com.

“How Many Bitcoin Users Are There?”, Buy Bitcoin Worldwide.

“Bitcoin doesn’t incentivize green energy,” The Block.

“How Much Energy Does Bitcoin Actually Consume?” Harvard Business Review.

“Renewable Energy Curtailment 101: The Problem That’s Actually Not a Problem At All”, Union of Concerned Scientists.