Libra’s Mission Impossible

Facebook-led Libra wants to provide a global currency to the 1.7 billion individuals who are unbanked, the overwhelming majority of whom reside in developing nations. The Libra white paper and the many discussions that ensued failed to mention that many developing nations already have vibrant mobile money/e-wallet services with specific goals to serve the unbanked. Those services enjoy regulatory support, possess local know-how, and operate on-the-ground distribution networks. They still have a long way to go but are generally growing at healthy rates.

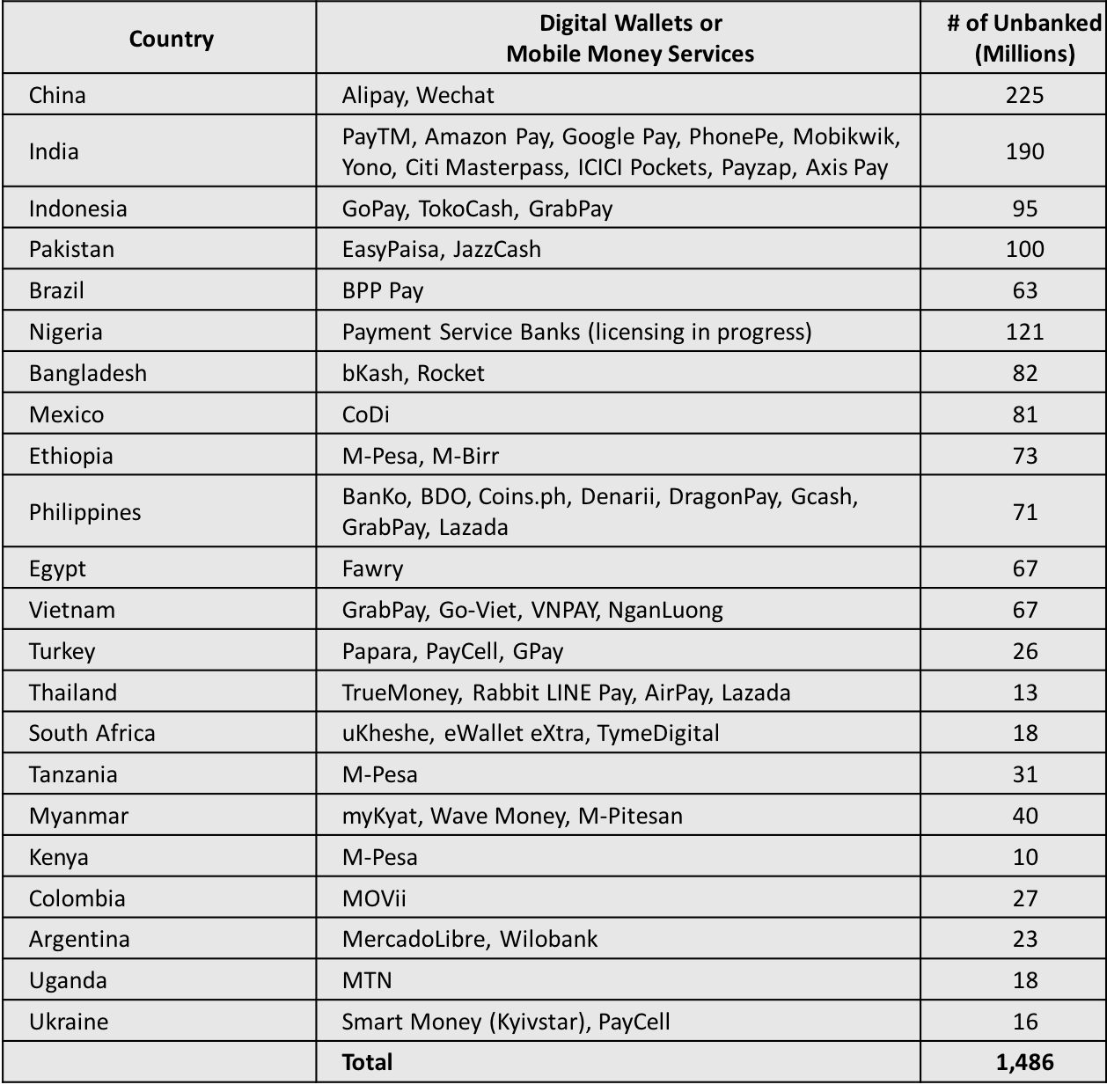

Twenty-two developing nations are home to about 85% of the world’s unbanked. All those countries have enacted mobile money legislations and have operational e-wallet providers at varying levels of maturity. Many of the other smaller 100+ developing countries have also forayed into mobile money, like Jordan which I covered in this article. Libra’s target market is crowded with competition and, especially given the geographic dispersal and regulatory fragmentation, is virtually impenetrable.

In the table below, I list the 22 countries representing 85% of the unbanked, along with their most prominent digital/mobile wallet providers:

I have yet to find a good reason for a country to freely allow Libra or for an unbanked person to be concerned with local currency conversion into or out of Libra when they pay local bills or transfer money to family members across town.

This Financial Times Alphaville article exposes more weaknesses in Facebook’s Libra announcement: (1) a lack of discipline in the research, which conflates US with developing nation data, and (2) addressing the unbanked problem as a systems challenge rather than a sociological one, as it should be.

I agree with Alphaville, Libra will end up looking much different than what its founders initially envisioned.

=====

Originally published on my LinkedIn profile on June 27, 2019.