Libra's Commitment to Financial Inclusion is Flagging -- An Update

Welcome to the latest edition of my newsletter. If you are not a subscriber, please use the button below to sign up. You can send your feedback to mohammed@ovahi.com or @ghalayini_m. And if you enjoy today’s essay, please share it with others!

Last year, Facebook revealed a cryptocurrency and payment system called Libra. At the time, I joined a chorus of skeptics in saying that the project was misguided and must change for it to survive. Change it did. In April 2020, the Libra Association released its white paper v2.0, describing how it would assuage serious government pushback. The changes are significant from when Libra was conceived: offering single-currency stablecoins, fully complying with government regulations & controls, forgoing the permissionless blockchain design, and adding protections to prevent destabilizing fiat currencies.

In a concise analysis of Libra’s changes, Frances Coppola, an economics commentator, surmised that Libra “lost its soul” and foresaw a rather dull fate for its future:

Libra will comply with everything that governments demand, and in return, it will be absorbed into the existing international financial system.

Coppola attributes this fate to a “fatal” weakness: As opposed to Bitcoin, a revolutionary and independent currency system, “Libra’s architecture wholly depends on the existing fiat currency system – and on the whims of the governments that control it.”

This “capitulation” has also reduced to empty platitudes Libra’s financial inclusion mission. A mission of bringing the billions who are unbanked and underbanked into the fold of a modern financial system.

Every War Has its Victims

In the face of intense government scrutiny, the Libra project quickly became weaponized as a matter of national security; its defenders positioned it as a bastion of America’s global financial leadership and an answer to China’s digital currency plans. “China wins if Libra fails” was repeated by David Marcus, Libra co-creator, along with his lobbyists and friendly opinion makers. It’s now well-accepted that there is a digital currency “cold war” or “space race” between the US and China.

This weaponization may have improved Libra’s standing in Washington, D.C., but at the same time, it has depreciated its financial inclusion pursuit.

Libra’s priorities are muddled. Positioning Libra as a US national security matter will no doubt be in tension with the hyperlocal needs of the ~1.7 billion unbanked who are dispersed across 130+ developing nations. The currency “cold war” is not being fought over the mundane financial needs of the impoverished; it’s a battle over the status of the world’s reserve currencies.

Libra is disengaging from developing nations. More than 90% of Libra Association members are North American or European; none are in countries with large unbanked populations. Two defections from the Libra Association last year are revealing: Mercado Pago, a payments platform from Argentina, which has a significant unbanked population; and Vodafone, which decided to favour its M-Pesa payments operation in Africa. Libra’s plans alarmed and alienated the two serious financial inclusion providers.

Without meaningful participation from the many local digital payments innovators, Libra cannot genuinely serve the unbanked.

A Wolf in Sheep’s Clothing

The Libra white paper v2 outlines a solution to help the financially excluded and underbanked masses, something it calls “unhosted wallets.” These digital currency wallets are essentially unregulated; they are not housed within financial services institutions. An individual can presumably open and own a wallet without going through cumbersome KYC checks, like presenting personal identification. Libra believes that unhosted wallets would lower individuals' barriers to enter the financial system. Strict controls and balance and transaction limits would be imposed to minimize the risks of money laundering, tax evasion, and terrorism financing.

There are a few problems with the unhosted wallet concept:

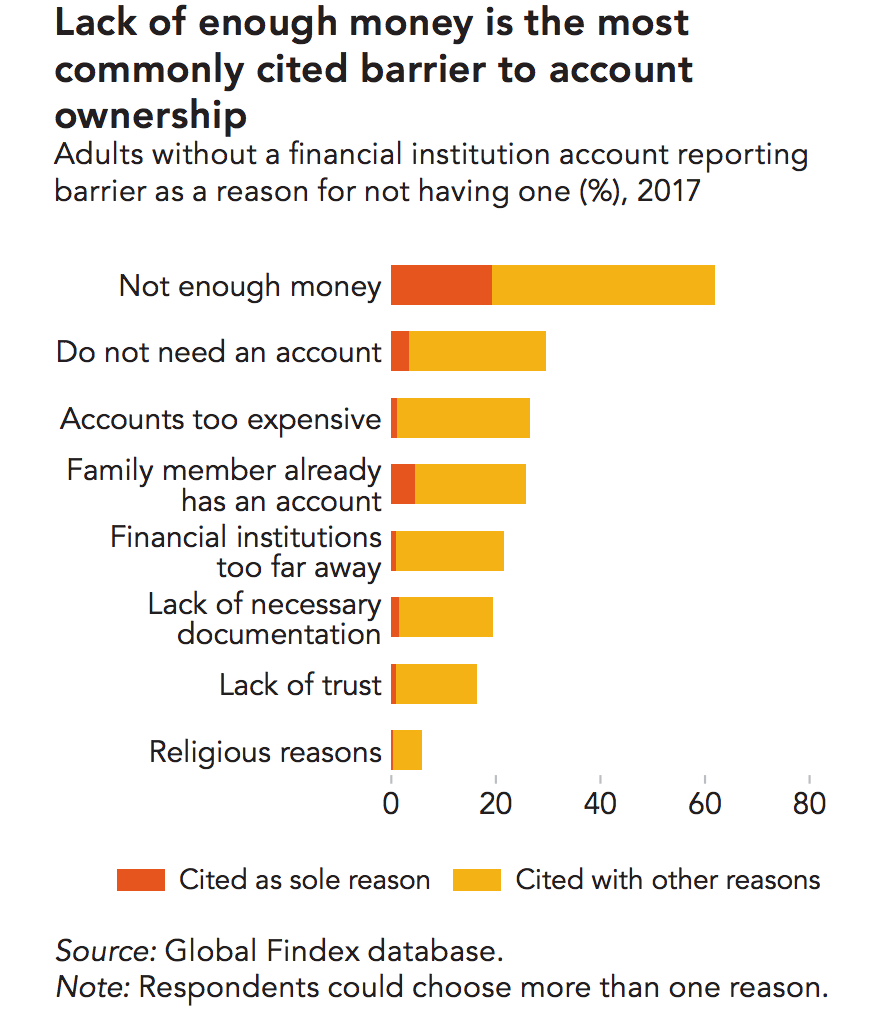

The chart below from the World Bank shows that, amongst the unbanked, poverty is the primary reason for not participating in the financial system. Other top reasons are related to financial literacy, culture, and religion. Of course, these reasons will vary widely from one nation to another.

Unhosted wallets are zeroing in on eliminating the frictions of KYC checks; this is a very narrow solution that falls quite short of Libra’s lofty goals.

While they may seem innocuous, unhosted wallets come with an unintended (or perhaps intended?) consequence; they would give Facebook a significant unfair advantage. The frictionless experience of opening an account built on Facebook’s massive platform would provide its e-wallet, Novi, with an unstoppable customer acquisition engine. Novi would have access to 2.7 billion active users from Facebook, WhatsApp, Instagram, and Messenger. This powerful competitive advantage would crush local digital payments companies who have been investing in physical distribution channels for years.

Facebook, through Novi, is a major influencer within the Libra Association. This problematic related-party situation was on display when Mark Zuckerburg, Facebook’s CEO, and David Marcus, Head of Facebook Financial, defended Libra publicly. The conflict of interest, hopefully, will stir regulators to challenge Novi; a precedent has been set with Brazil’s recent suspension of WhatsApp’s payments system to “preserve an adequate competitive environment.”

Fintech is “Default Local”

Financial inclusion in a nation can only happen by adopting a hyperlocal approach that takes into consideration its unique cultural, economic, and policy contexts. National and regional fintechs have been working on the problem for years and have seen some great results. For example, in Kenya, where M-Pesa and other fintechs have been active, financial inclusion jumped from nearly 27 percent to almost 83 percent within 13 years.

But, financial inclusion has a dark side. The fast proliferation of credit apps exposed many people to debt spirals, fraud, and negative behaviours. These problems can only be addressed, again, at a local level through financial literacy, regulation, and law enforcement.

The famous Silicon Valley VC firm, Andreesen Horowitz, which, ironically, is a member of the Libra Association, said this about the significance of local fintech:

Fintech is default local, not default global. Unlike software or a social network that can be “turned on” in any geography, fintech products must receive local regulatory approval, offer local payment methods, and work with local bank partners — all of which takes time, talent, and money. Additionally, over the last 10 years, local fintech players have emerged around the world, posing formidable competition for foreign entrants.

I wholeheartedly agree.

=====

Sources & Notes:

The image is of Mark Zuckerberg at the Libra congressional hearing in October 2019. Source: The Financial Times.

Libra White Paper V2, Libra Association.

“How a Fatal Weakness Forced Libra to Capitulate,” Frances Coppola.

The Global Findex Database, The World Bank.

“Libra Is Ready for the Digital Money ‘Space Race’,” CoinDesk,

“This lending app publicly shames you when you’re late on loan payment,” Rest of World.