Canadian Fintech has a Financial Inclusion Problem

Gary Newman works with youth with a history of conflict with the law (like ex-gang members) to help them build solid financial foundations. He believes that sound financial skills can profoundly transform the youth’s lives and keep them away from their past troubles. I met Gary almost 2 years ago; we recently caught up discuss his work and his impressions on obstacles faced by Toronto’s marginalized communities.

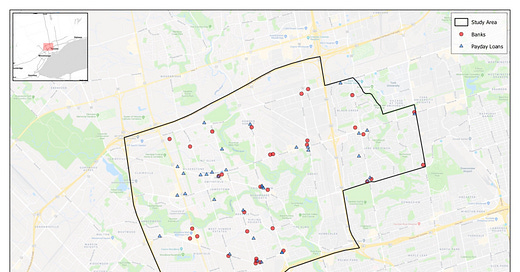

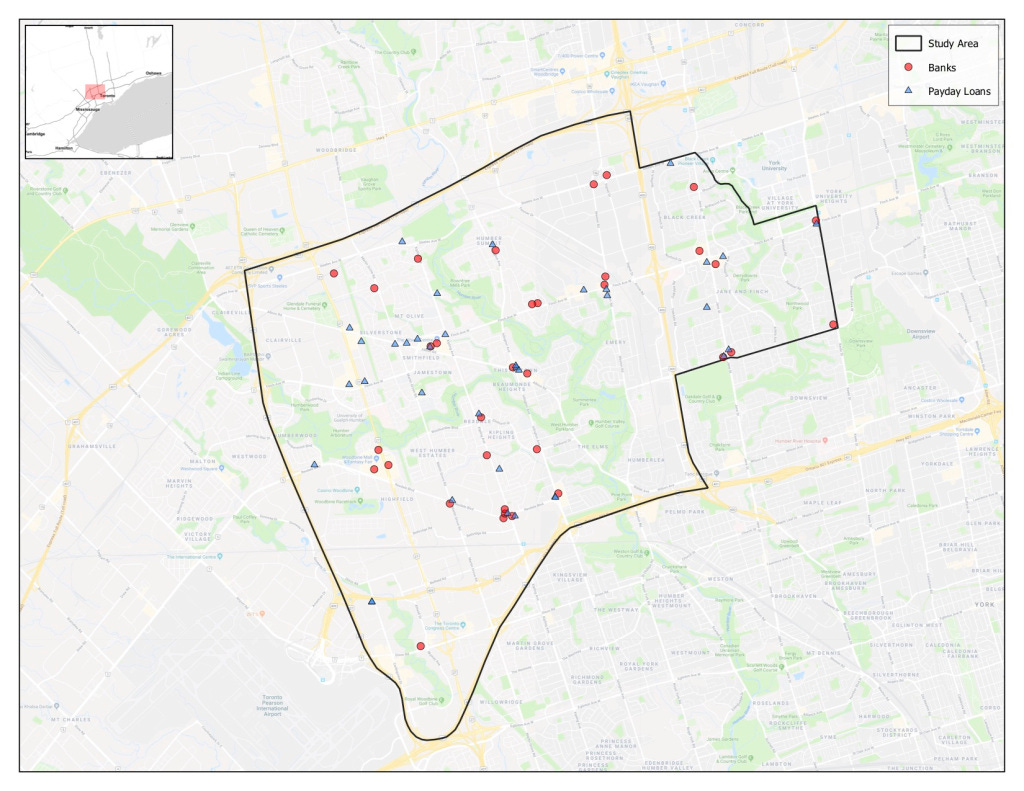

Gary suggested that I drive along Finch Ave (between Highway 27 and Yonge St) and take in the billboards and storefronts along the way and note how the less-affluent communities are being served. So I hopped into my car a few weekends ago and did the “Finch Drive”. It was easy to spot what he was referring to: among the purveyors of “Jobs, Jobs, Jobs!” and private investigator services there was a large number of payday loan shops. I dug a bit deeper and counted 35 payday loan shops vs. 34 bank branches within a few neighbourhoods along Finch. Predatory lenders in Toronto, despite the city’s restrictions, are thriving on marginalized communities.

This map shows the locations of payday loan stores and bank branches in the following neighbourhoods along Finch: Rexdale, Jane and Finch, Thistletown, and Humber Summit – some of Toronto’s poorest neighbourhoods.

The numbers illustrate the financial challenges faced by the residents of Toronto’s marginalized communities, low financial literacy and the absence of viable services are driving people to relieve their financial needs at a great cost and risk of spiralling debt cycles.

A 2018 study by the Angus Reid Institute found that 16% of Canadians are “Struggling”, meaning that they face financial challenges that negatively affect their quality of life. This problem is not insignificant and is concentrated within marginalized communities.

Given the above, I was surprised to find out that the Fintech innovation community, within both startups and large banks, have mostly ignored the problem.

Financial Inclusion Innovation in Canada

According to the World Bank, Financial Inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit and insurance – delivered in a responsible and sustainable way. In other words, this means that products and services must be concerned with benefiting users’ pocketbooks first and foremost. This might sound banal, however, Fintech innovations have instead contributed in suboptimal results for users, like consuming more debt, entering into long interest payment cycles, or trading too frequently.

Less than 2% of Canadian Fintech Startups Are Addressing Financial Inclusion

So what are Canadian Fintech startups doing about Financial Inclusion? I reviewed Ferst Capital Partners’ 2018 map of Fintech Startups in Canada. A couple of takeaways:

Within the Personal Finance category only 6 startups were helping users save money and 2 provide financial education tools for children. That’s 8 out of a total of 426 Fintechs. Most other Personal Finance startups offer financial planning services, price comparisons, or credit/debit cards. The latter two categories encourage users to spend more and take on additional loans.

Within the Lending category, I counted 10 personal lenders charging usurious annual rates as high as 59.7%, flirting with Canada’s 60% criminal rate. There was also one digital payday loan provider that charges between 391% and 495.36% annual rates (payday lenders are exempt from the criminal rate ceiling). These lenders tend to use marketing techniques that deemphasize users’ obligations and emphasize a one-click solution to life’s problems. They are dangerously easy to access and can potentially entrap vulnerable users who possess low financial acumen.

There are many reasons for why the Financial Inclusion category isn’t bigger within Canada’s Fintech space. Mainly, the size of the addressable market might be too small to be attractive and the road to profitability might be murky, driving away entrepreneurs and investors. I also think that effective engagement with vulnerable communities is limited to certain pockets at the margins of the startup innovation ecosystem (e.g. Social Ventures Zone, Centre for Social Innovation).

Canadian Banks’ Innovation Labs are Not Prioritizing Financial Inclusion or Literacy

The big Canadian banks’ innovation labs haven’t been (at least not noticeably) investing in Financial Inclusion or services targeting marginalized communities. For instance, RBC Venture’s stated goal is “to move beyond banking” to engage customers “early in the value chain”, a conspicuous lead generation operation that aims to convert 500K users into banking clients (Source: RBC Investors Day, minute 125 onwards). A quick review of RBC Venture’s products and services confirms that financial inclusion is not within this strategy. RBC did in the past invest in social finance, but the figures pale in comparison to its $3.2B commitment to innovations that aim to woo new clients.

Other banks’ innovation labs seem to be concerned with optimizing their products to better serve existing clients (e.g. contextual apps, conversational AI) or are still educating their organizations on the benefits of innovation. I haven’t spotted new bank products that are useful, affordable, responsible, and sustainable and that are targeting vulnerable Canadians. I hope to be corrected very soon.

Why is this the case? The authors of this article put it best: “…one big pitfall of the innovation lab approach is that it results in a disconnect between the innovator and the user. Inclusive innovations are born in the field, through a deep understanding of the realities, constraints and environment that the user operates in.”

Corporate Responsibility Groups Must Step Up

In Canada, more has to be done to lessen the burden of consumer debts, offer viable alternatives to payday lenders, encourage savings habits, and better financial literacy. In addition to fully understanding the contexts of marginalized communities, inclusive innovations should capitalize on behavioural economics techniques, peer-to-peer or communal savings/loans, and digitizing age-old financial solutions. And, dare I say, the established credit score model should be challenged with alternatives that reflect the daily realities of Canadian consumers.

The question remains, how will this be funded. Large banks’ corporate responsibility departments, like TD’s The Ready Commitment, should own a larger portion of the innovation agenda. Investing and offering grants is a great way to start, but more has to be done. Bank corporate responsibility groups can form their own incubators, partner directly with social startups to help them tap into much needed resources, and raise the profiles of socially minded accelerators.

The bottomline though is that innovators must “get out of the building” and be with struggling Canadians, like those who live in the neighbourhoods along Finch. More understanding will breed new solutions.